If you need fast access to cash but don’t want to put your business in dept, invoice factoring may be the alternative you’re looking for.

Release Your Cash From Unpaid Invoices by Factoring

How much funding are you looking for?

Invoice finance factoring

It’s a form of short-term business finance for businesses that offer credit terms to customers (a valuable sales tool and a strong customer incentive, but one that can tie up your valuable working capital and leave you short on cash for regular outgoings like tax, wages and utility bills).

Invoice factoring, also known as ‘invoice finance’ or ‘accounts receivable finance’ involves selling your unpaid customer invoices to a third party. You’ll get an immediate cash advance, usually between 70% and 90% of the value of the invoice, and the factoring company will take on the responsibility of collecting payment from your customer.

Once the customer pays their bill, the factoring company will deduct their fee, and then pay you the remainder of the invoice amount.

Types of invoice factoring

Recourse Factoring

With recourse factoring, you will be required to buy back the invoice in the event the customer fails to pay their debt, which means that you still have all the risk of non-payment.

Should that happen you’ll have to repay the advance to the factoring company and pursue the customer for the bad debt.

- You issue your customer an invoice

- You sell the invoice to the factor

- The factor advances you your agreed % (i.e. 80%)

- Factor collects payment from your customer when due

- Factor pays you the balance less their fee

If factor is unable to collect payment from your customer,

- Factor requests advance back from you

- You have to now try and collect payment from your customer

Non-Recourse Factoring

Non-recourse factoring, on the other hand, transfers all the risk to the factoring company.

If the customer does not pay then you will not receive the balance payment, but that’s the full extent of your exposure.

- You issue your customer an invoice

- You sell the invoice to the factor

- The factor advances you your agreed % (i.e. 80%)

Many factoring companies won’t offer this form of finance – or will only do so for those of your customers who have a strong credit rating – and you can expect to pay more if they do.

The biggest downside to non-recourse factoring this is that you will have no control over how the factoring company behaves towards your customer while pursuing the debt, which could have a very detrimental impact on your business relationship.

Spot Factoring

ideally, you’ll be able to pick and choose which invoices you sell, and when, so that you can get a cash injection when you need it, without being locked into an expensive form of finance during the times when your cash flow is strong.

Spot factoring, or ‘single invoice discounting’ allows this, but you can expect to pay more for this flexibility.

Whole Ledge Factoring

Whole ledge factoring requires you to sell all the invoices from a particular customer – or in some cases, a specific number or value of invoices each month – to the factoring company, regardless of whether or not you need the cash at that time.

This usually attracts lower fees than spot factoring, but is far less convenient.

How factoring works

Once you’ve set up your facility, factoring is a straightforward process. At the start of the process, once you’ve issued an invoice on 30, 60 or 90-day credit terms, you provide details of the invoices you wish to sell to the factoring company.

They will then advance you an agreed percentage of the invoice amount. Once the invoice falls due, the customer will make payment direct to the factoring company, who will then deduct a fee for their services. They’ll transfer the remaining funds (known as the ‘rebate’) to you.

Send your customer your invoice

Send the invoice to the factor company

Factor company checks the invoice and verifies the service was completed

The factor advances you a large portion of the invoice

The factor awaits payment from your customer

Customer makes payment and the invoice forwards you the last remaining portion minus fees

Where can I get invoice factoring?

Invoice factoring is a common form of business finance available from a number of sources.

You could approach your bank, but only if your businesss is an established business that meets the bank’s strict lending criteria.

Alternatively, there are many fintech lenders who offer invoice factoring, including some that specialise in this form of finance for specific business models or industries.

When it comes to choosing a factoring provider, it’s important to do your research. Alternative lenders are not regulated in the same way as the big banks, so it’s vital that you check their conditions as well as investigating all the fees and charges while comparing your options.

If you’re looking for flexibility, avoid providers that require long-term contracts or whole ledge factoring – you can expect to pay more for the freedom to choose which invoices you sell, and when, but being locked in to an arrangement that no longer suits your business could have a negative impact on your financial position in the long term.

As well as considering terms, conditions and fees, research the factoring company’s reputation – remember that they will be dealing with your valuable customers, and if their methods are aggressive they could do serious harm to your business relationships (and, by extension, your own precious reputation).

Applying for invoice finance

Unlike most forms of business finance, factoring does not involve borrowing, so the application process is usually quick and straightforward.

While your business and financial circumstances may not come under the kind of scrutiny you can expect when applying for a business loan, the credit-worthiness of your customers will have a strong bearing.

If you’re opting for a fintech factoring provider, you can expect to complete the application process online, by filling out a simple form and uploading some supporting documents.

You’ll probably be asked to provide:

- ID documents

- A list of your customers

- Copies of the invoices you want to factor

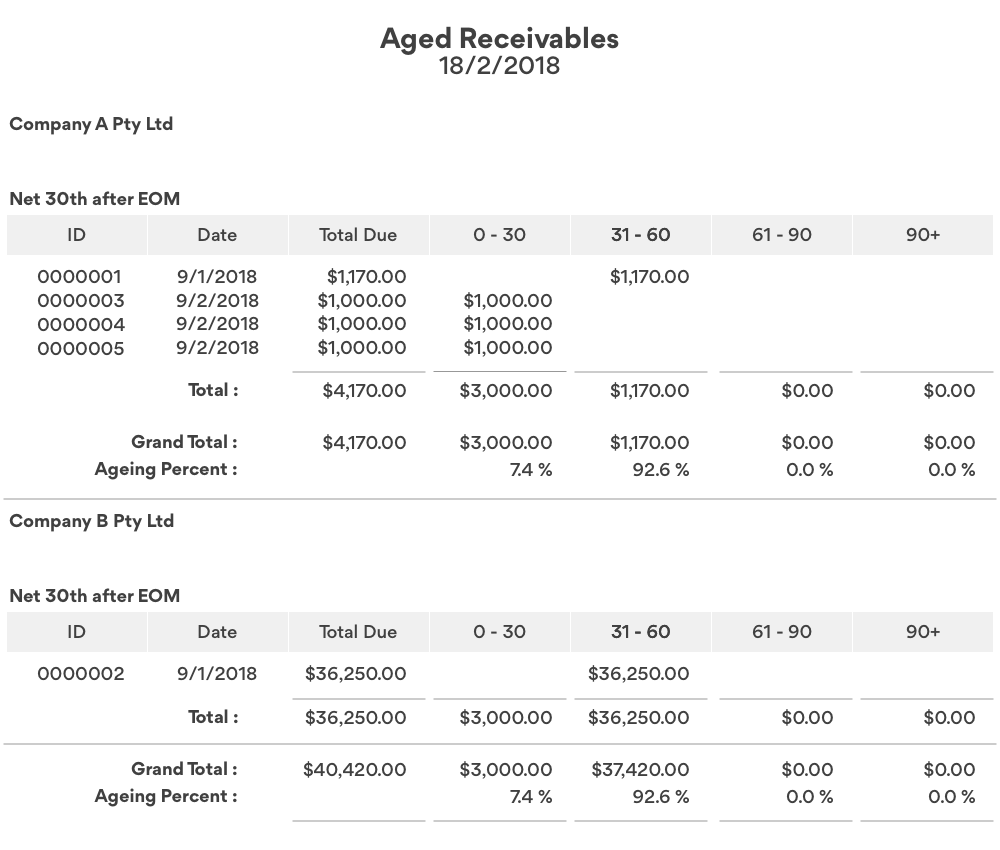

- An ‘aging report’ for your accounts receivables, so that the factoring company can see how quickly your customers typically pay their invoices

Aging report example:

In most cases you can expect your application to be processed within a few days.

As soon as your facility is set up, you’ll be able to start selling your invoices and receiving cash advances immediately.

Invoice factoring fees and charges

With invoice factoring you do not pay interest, since you are not borrowing money. Instead, you will be charged a factoring fee, which will be an agreed percentage of each invoice you sell. This generally varies from 1.5% to 4.5% per 30 days outstanding on the invoice.

As with any form of business finance, the fee rate you are offered will vary considerably depending on the lender you choose and the terms and conditions of your facility (flexible spot factoring will be more expensive than whole ledge factoring where you agree to sell invoices in bulk).

The percentage you will receive as an advance, and the factoring fee you’ll be charged will also depend on:

- Your customers’ credit rating

- Your industry / business model

- The credit terms you’ve offered to the customer (invoices that aren’t payable for 60 or 90 days will cost more than those due in 30 days)

You can expect to pay a ‘factoring fee’ which is a percentage of the invoice amount. This will generally be somewhere between 1.5% and 4.5% per 30 days outstanding. There may be other costs such as admin charges and money transfer fees.

The pros and cons of invoice factoring

Pros:

- Quick and simple application process, generally with less scrutiny of your business than debt finance.

- If you have customers with strong credit ratings, you may be able to access invoice factoring even if your business is newly established or has not yet built a strong credit record.

- Once your facility is set up, invoice factoring is very quick – you will usually receive funds in your account within 24 hours of selling an invoice.

- The factoring company will take on the stressful and time-consuming process of debt collection, especially if you are able to access a non-recourse financing facility.

- Invoice finance will not show on your balance sheet since it is not a form of debt finance – so it won’t affect your ability to apply for a business loan later.

- Invoice factoring may allow you to offer better credit terms to customers, which can be a powerful competitive advantage.

- Spot or single invoice factoring can offer you total flexibility, with the right to choose which invoices you want to sell whenever you need a cash injection.

Cons:

- With invoice factoring get convenience and instant cash – but that flexibility comes at a cost, especially with spot financing. Factoring is generally more expensive than other forms of finance, and you need to be wary of hidden costs like money transfer fees when comparing providers.

- When you sell your invoices, you lose control over the relationship with your customers – if the factoring company behaves in an aggressive or unprofessional manner this could permanently damage your relationship.

- By selling your invoices you make your customers aware that you are having cash flow issues – which may make them wary of dealing with you in future.

- If you aren’t able to access spot factoring, you could get locked into a contract where you are forced to sell a specific volume of invoices each month, or all invoices for specific customers, whether or not you need the cash – which will eat into your profits.

- Some factoring companies will seek to restrict which customers you can do business with, based on the customers’ credit ratings.

- Recourse factoring leaves the risk with you, so if your customers fail to pay you will be forced to buy back their invoices and pursue bad debts yourself.

- Some factoring contracts have hefty fees for early termination or may require you to buy back any uncollected invoices should you close the facility – this can make it difficult to exit an unfavourable agreement unless you have sufficient cash on hand to repay all the advances.

Should I consider factoring for my business?

Cash flow shortage is the number one reason small businesses fail...

...factoring allows you to bridge the gap between providing a service and receiving payment, which is why factoring is so popular – especially for businesses with heavy up-front costs such as materials, labour and transport.

In a competitive market, being able to offer longer payment terms can be a valuable edge that can help you secure customers, and factoring can make that possible by giving your working capital a boost to cover your costs of doing business.

However, factoring is generally more expensive than other forms of short-term business finance and can impact your business relationships and reputation, so it’s important to consider all your options before entering into a factoring arrangement.

As always, it’s a good idea to to seek independent advice from your financial advisor to help you decide if factoring is right for your business.

very quick service